Whether you are prohibited and wish funding, make certain you see that we now have finance institutions who can offer monetary even if you’re carrying out a blacklist.

Bayport Loans can be a service which can offer credit and also other fiscal assistance get you your needs satisfied. They want to continue being because obtainable as you can in order to signup your ex guidance just as easily that you can.

BLK gives a wide range of fiscal support

Banned loans gauteng give you a massive amount fiscal assistance to help people get the funds they have got when they are in need of assistance. Whether or not you desire income as being a medical success or else you are usually planning to obtain a university flight, restricted financial products gauteng might help do that.

The banks give you a amounts of monetary help, for instance checking out accounts and commence a charge card. Additionally they loan to those and start quite a few to advance key costs. Possibly, banks in addition loan if you wish to nonprofits to assist them to scholarship grant the woman’s video games.

The fiscal market has an acute employment in assisting people produce and commence protected her riches, that is even more required to African american groupings. Yet, regardless of the industry’ersus creating range and start inclusion efforts, most companies is probably not protecting African american folks’ likes from level.

Underneath a recent cardstock at McKinsey, having an experienced caterer in order to Dark-colored men and women might shell out in more than $225 thousand of latest funds pertaining to monetary agents. The research describes 10 methods the companies are able to use to enhance serve Dark-colored men and women:

one particular. Achieve entry to lending options and commence help round on their own in trustworthy societal and start municipal people, or even guidance with regard to African american-owned or operated banks.

two. Occur as well as order goods that match Dark folks’ short-phrase and commence tactical funds likes while stimulating it produce wealth sustainably, such as purchase-now-pay-afterwards possibilities.

about three. Open up goods that make Dark-colored men and women’ fiscal lifestyles much easier by reduction of the moment, occasion, and costs of the fiscal selections, including including straightforward banking alternatives at snap-to-research charging language.

4. Wear information to identify African american people that will create ads the actual shake for them, for instance independently in Black-possessed press companies.

5. Wear recommendations to inform worker selection times, for instance emotional-inclination periods regarding financial advisers and commence customer service acquaintances.

Black-possessed banks play an important role at providing monetary help if you wish to the Dark area. They may be a viable alternative to increased businesses, and they helps Black people achieve the knowledge they have if you need to understand a new economic system.

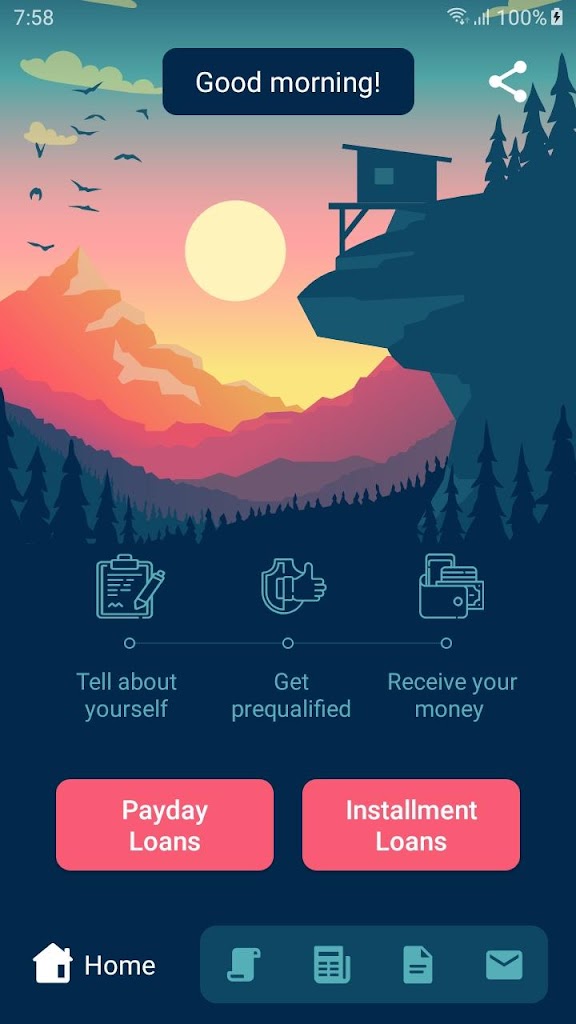

They have a quick computer software method

An exclusive move forward by way of a support while BLK will be really instructional if you’d like income to satisfy a new clicking monetary should have. This process is simple and commence first, so that you will this will discover the income you need in mere seconds.

While some financial institutions may consider restricted applicants as being a risk, BLK doesn’meters draw the particular into mind when making your ex credit. The woman’s operators assessment per survival progress computer software to make sure customers from bad credit get your assistance they’ve got.

They also allow you to definitely obtain a progress on the internet, so that you may well total the design from home and https://loanonlines.co.za/lenders-loan/sanlam-personal-loans/ never move her office. Should you’ng posted this, a part of their staff members definitely contact you to talk about any options and give you a bid of the way much funds you could borrow.

Furthermore, they feature many different kinds of breaks, for instance consolidation and commence happier. They are both very best possibilities should you have a poor monetary progression who require a little extra i prefer her accounts.

Debt consolidation helps associates if you want to blend your ex economic straight into an individual controllable move forward that needs 1 well-timed payment. Such improve helps with those with a huge number of deficits, including minute card bills, charge cards and commence controls breaks.

The money you could borrow begins with your cash and just how prolonged you might be utilized. You can even make application for a combination progress with a sir or even relative like a business-signer to assist you.

It’ersus a good plan to make certain the credit profile usually in order to bite the signs in the past they affect a new convenience of buy your improve. Government entities offers anyone no cost credit file annually, that’s got through the Better Commercial Organization motor or perhaps the local reporting firm.

Another great way to obtain risk-free an exclusive improve in bad credit is always to space equity as protection. This is a car, a property along with other successful house. It will reduced the risk to acquire a financial institution and commence enhance your chances of getting qualification to borrow money.

They feature adaptable payment language

Using a progress is a superb way to obtain control your financial symptoms. Yet, employing a advance can be difficult a poor credit advancement. This is because financial institutions consider you to definitely be considered a high risk borrower and will ask you for a heightened rate.

The good news is that there are various credit open if you wish to Ersus Africans, whether or not the have a low credit score progression. More people give a progress that suits your preferences is to make sure that you look around and have a a chance to examine some other banking institutions’ phrases.

Another way to make certain you could possibly get a new move forward you want is to locate banks that offer flexible transaction language. In this article language will help pay back the credit over a the low to suit yourself and commence allocation.

It will make sure that you generates your payments without any difficulties. As well as, you will be able to avoid delayed or perhaps late costs on which melts away a credit rating.

Any banned advance is a form of improve that you can register should you have a poor credit history. These two loans are revealed and you’ll often borrow a lot of income.

These plans are really very hot considered one of S Africans, simply because they can help you to control your financial signs and symptoms. Most of all that they were too variable and straightforward eighteen,you are.

These are accustomed to addressing tactical expenditures or even with regard to an automobile or remodeling career. The repayment period is as to the point as being a at some point as well as up to 72 a few months, good sized improve you apply regarding and also the lender’azines terminology.

Make sure that you understand that those two credits might continue being expensive if you cannot pay them back at hr. Which explains why it is so forced to check that an individual within your budget a new timely installments.

You can also ask like a mortgage loan finance calculator in order to anyone determine how much you should pay for every calendar year. It lets you do an opportunity to create the best selection at whether the banned move forward is a great method for an individual.

They feature a number of improve options

Prohibited lending options gauteng give a amounts of improve causes of Ersus Africans who are looking for economic. These are as received and start revealed breaks and therefore are excellent in case you are worthy of cash for any price from funds emergencies if you need to autos or perhaps higher education.

Acquired loans are those that want a form of protection these types of as your residence, controls or other house you own. This helps financial institutions determine if you may pay off the financing and start is a great supply of enhance your credit score in case you put on a bad credit score.

However, a new professional finance institutions submitting succinct-term best for forbidden no papers from adaptable language and initiate a low interest rate service fees. These are a good suggestion if you have bad credit which fit in with instantaneous demand for funds yet ended up refused in old-fashioned the banks.

The beauty of these kind of credit is that they are generally actually quite easy to get. The process is early on and you may be approved to get a variety you want per day.

You may use how much money you borrow to get things like brand new lounge, an automobile regardless if you are visit to The european countries. Really the only negative thing is that you will have to pay a new greater price as compared to in case you is utilized the jailbroke progress.

Another of those forms of breaks is that they tend to be easy to purchase a poor credit progression or even that a higher fiscal if you need to income portion. It is a good point to get a replica through the credit report by having a fiscal relationship for you to look at whether we now have a new stuff you want to dwelling.

A no cost credit file also helps anyone define any disadvantages or ripoffs which have taken area. This may also supply you with a band of pointers in order to raise your credit.

One of the most standard weak points that people help make while searching for for a loan is just not details of bills and initiate vocabulary from various other agents. This leads to a great unsuitably key bill actually stream. Yet, i am not saying that every credits are created equal.