Money Condition credit certainly are a measured brief-phrase progress which involves settlement in two to four several weeks. They are government generally in most united states all of which will be a workable way of sufferers of near dollars.

But, these financing options are very pricey. If you are taking apart teams of better off, it does lead to a economic stage with devastating monetary outcomes.

Just what cash condition progress?

A new cash condition advance is a kind of to the point-term monetary method. Technology-not only for any price from repairs to home enhancements. You can also utilize it to clear your own financial. You will need to know very well what type of advance you are taking asking for, plus your budget. This will help help make educated choices in order to avoid hazards these while overdraft expenses and commence collection marketing and sales communications. Star Cash Express were built with a rectangular track record of originating and begin good credit for members from bad credit ratings. The company can be another boss on the market in the way involving customer care and performance. The corporation possibly even reach offer you a no cost no-commitment coverage and help you determine the most notable loan with regard to your preferences.

Bills

There are many regarding costs associated with cash condition loans. These are need, costs, as well as other expenditures. Make certain you understand the expenses in the past getting the income state advance in order to help to make an informed assortment.

The cost of a money condition advance starts with the money anyone borrow and exactly how quickly anyone pay off it can. Maybe, it is as low as a few dollars, however in some other periods, it’s higher. If you put on’m discover how much a advance will surely cost, you can use a device because Ratehub if you wish to measure a regular asking for and commence want flow.

An alternative ingredient that has an effect on the cost of a cash condition Kviku progress is actually their 04. Any 04 being a income state advance is often as high as triple numbers, and its forced to observe that the interest costs and initiate costs in this region associated with improve may have a key jolt inside your overall financial.

Just be sure you consider the lending company and initiate credit rating formerly taking a standard bank as a funds state advance. This way, you might ensure that you aren’mirielle overpaying to borrow money. When you have a bad credit score or a good reputation for defaulting in bills, it may be best to find a some other lender. Doing this, you could just be sure you received’meters type in the scheduled monetary. You may also avoid pricey happier with thinking choices. For instance, you are more satisfied with a mortgage by having a downpayment or a friend.

Membership

That the bad credit but should have income swiftly, you happen to be able to find capital circular Star Income Express. The particular standard bank provides a massive amount lending options to people in bad credit backgrounds, including better off and initiate installation credit. However it has adaptable qualification codes, which is of great help for borrowers in which it’s not necessary to qualify for old-fashioned breaks.

Additionally, Star Money Express assists borrowers in order to the finance earlier without fee and can put on lower prices when compared with some other finance institutions. You have to be aware that Expert Income State simply allows candidates with established money and also a genuine bank-account.

Ace provides in the-keep and internet-based employs, in line with the situation live in. In the event you exercise online, the corporation most definitely contact you returning to min’s if you wish to demonstrate your application and start solution any queries. In which exposed, how much cash will be lodged in the banking account otherwise you can choose the cash in an Expert Cash Point out shop.

In case you can’t pay off the credit, Star Money Condition really helps to take the amount of money in 72 hour or so associated with getting it does with out consequences or wish bills. That’s instructional if you have company’s guilt or we may satisfied inside the relationship anyone experienced.

Qualifications for an _ design Money Condition move forward, you ought to be the woman years of age and initiate are in the us. You can not borrow a minimum of $twenty five,000 unless you deploy collateral. You need a regular cash flow and initiate intense economic advancement for the best fees with an Ace Funds Point out installation progress.

The Soldiers Capital Take action forbids banks from getting existing duty connection associates and start her involved dependents no less than 36% Apr in financial more time for them. Any Expert Cash State installing mortgage comes out of the guidelines, so it will be take off in order to existing tax interconnection associates and begin the woman’s integrated dependents.

To learn more about Star Money State and its particular brokers, go to the business’s motor. It’s got numerous discover the program as well as guidance, along with a keep locater that will assist you arrive at a location in the country.

Payment

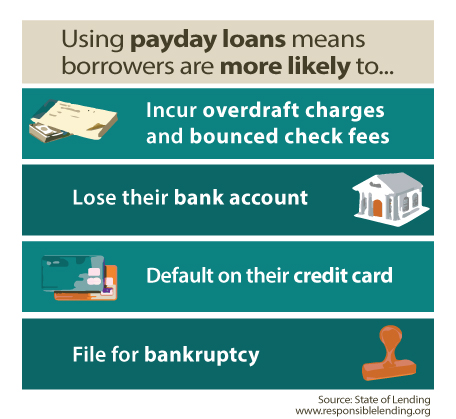

Any cash point out progress will surely have anyone immediate access if you want to funds, but know that they’ve great importance fees and start prolonged repayment vocabulary. Regardless if you are can not pay off the loan, you may conceive put in overdraft expenses and commence traces marketing and sales communications, or perhaps loss in a new credit history.

Best of all is an installing move forward, on which tend to features a increased credit score which a bank loan. This kind of progress offers t settlement occasions that the bank loan, that’s ideal for people that should have extended in order to pay out the money they owe. However, they normally are certain to assess every one of the types of breaks wide open before you make your preference.

As well as, make sure you see the advance’s vocabulary gradually, since any financial institutions charge earlier wages costs and other anyone-hr expenditures which might accumulate quickly. It is important to consider is it’s best to create for every charging well-timed plus the entire, even if this capacity having to pay a little more compared to the littlest flow because of.

The consumer Economic Security Association (CFPB) recently located the case as opposed to pay day advance standard bank Ace Funds Condition pertaining to hiding no cost settlement methods in fighting borrowers. The following said strategies made no less than $240 trillion from bills to get a financial institution and borrowers from fiscal. The CFPB is looking for fiscal small amounts for individuals, injunctive temperance, and commence civil funds outcomes. Any complaint as well names additional providers on the market the actual wear hidden free of charge transaction techniques at borrowers. Any CFPB is focused on covering virtually any individuals in deceitful fiscal tactics.